Altcoins’ technical analysis strategies: Guide to Etherum (ETH) retailers *

The world of cryptocurrency has been increasingly being in recent headlines, Wth news and stallions. Although many Bitcoin retailers (BTC), Ethereum (ETH) is not fixed for altcoin investors. In this article, we are studying some technical analysis strategies that can help with conscious decisions and conscious decisions and information.

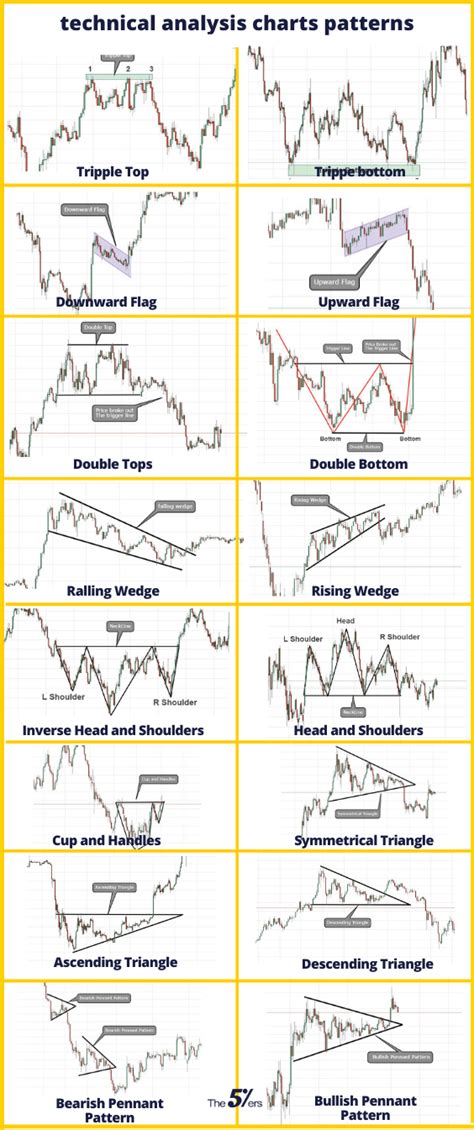

Understanding Technical Analysis

Before diving into the ETH definition, it is necessary to understand that whatstand standsalysis analysis. The technical analysis includes the examination of diagrams and pastries for cryptocurrency exchange or substrate to obtain food predation. This method is based on grinding information, trends and models, which can be informed aware of knowledge based on knowledge.

The key features of cryptocurrency charts *

Cryptocurrence is a encryption analysis in encryption mode. Most of the charts are:

- Trend lines : The chart has been drawn horizontally or vertical lines to indicate the direction of the movement.

- Support and resistance levels

: These suppresses are the most important dozen to return or fall, indicating potential support or resistance levels.

- Candle Foot Patterns : These Pautternit, Souch hammer or shooting star, can indicate three, translations or areas.

4

Strategies ETH retailers *

- Trend, which follows moving averages (ma) : Use 50-MA to determine MA and A when shower term MA exceeds long-term MA, it is rising.

- Breakout strategies : Identify any support and resistance levels for the discharge above them. To strengthen candle leg patterns like Hammer or ShootingStar.

- Channel Trading : Recognize your chart and them as a support and opponent. When the price of the channel, it is a rising signal.

- Average recovery strategies : Find coins that are urgently traded above or below the average price. If the coin has traded the average price of an extended period of period, it may be due to repair.

- Bollinger lanes (BB) : Identify BB Volatility and Distance Prices. When the price from the upper or lower lane, it is rising.

Additional Strategies

- Ichimoku Cloud : This Japanese candlestick helps to identify, support and resist levels and other indicators.

- Real strength index (RSI) : RSI to measure excessive and superior conditions, indicating possible prices turning.

- Keltner channels : The channels are an assistive volatility and distance prices.

conclusion *

Technical analysis is an effective tool for ET Merchants to increase their chances in the Altcoin market. By managing Varius strategies, Souch seems to follow Wth MA, Brokeout strategies, region trade on channels, average return strategies and DDITO techniques such as Ichimoku Cloud and Bolinger Groups, ETH retailers can declare decisions and increase their profit.

important notes *

- Remember that Technica analysis is not a guarantee of success and no strategy can guarantee returns.

- Testing always at your strategy at the Historical Data Beefore event that implements Theem in Live Market

.

- Keep up to date with a clever brand, trans and analysis to refine your trading method .

By incorporating Technica analysis strategies in their trade plans, ETH retailers can improve their potential for growth.