“Trade in chaos: increase in the liquidity of the cryptocurrency market”

The cryptocurrency market has recorded a significant number of popularity over the past few years, and prices have increased rapidly to an unprecedented level. However, under the surface of this market is a complex network of liquidity and trade activity, which may make navigation difficult for investors.

At the basis of cryptocurrency trading consists in buying and selling digital assets using various currencies, including Bitcoin (BTC), Ethereum (ETH) and others. To succeed in these markets, traders must have access to high quality liquidity, which refers to the possibility of quick purchase or sale of assets at a favorable price.

** What is liquidation?

Liquidation occurs when a trader has placed a large order for the sale of assets, but it cannot be met due to market variability or other factors. As a result, the trader’s order is tailored to another buyer, and the resource is sold at a lower price than the original sale price.

Liquidation may occur on cryptocurrency markets when the trader is trying to close his position on resources, which has fallen significantly. For example, if a trader sells 10,000 ETH for $ 500, but the market price drops to USD 200, it may remain with a significant loss. To reduce this risk, traders use different fluidity mechanisms, such as Stop-Loss orders and margin trade.

TVL: Miara of the liquidity of the cryptocurrency market

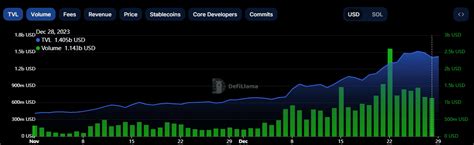

The total blocked value (TVL) represents the total value blocked in the stock exchanges and cryptocurrency portfolios. This is calculated by a summary of the total value of all assets on the stock exchange and by subtracting the initial amount of the deposit from each user.

In recent years, TVL has increased exponentially, and many investors are closing their capital to participate in commercial activities. According to data from Coinmarketcap, the total TVL exceeded $ 1 trillion for hard times in 2020. This increase in liquidity enabled traders to access a wide range of assets and trade on various stock exchanges.

Impact of liquidation

Liquidation can have a significant impact on the market prices of cryptocurrencies. When a trader plays a large order, he can cause a wave effect, causing a rapid increase in market price. In some cases, liquidations can lead to significant price fluctuations, which makes it difficult for traders to predict future price movements.

For example, in 2019, the mass liquidation event was exchanged for Binance, causes a significant decrease in the value of several cryptocurrencies. This event emphasized the need for liquidity mechanisms and risk management strategies to relieve potential losses.

Application

Trade in cryptocurrency markets requires a deep understanding of market liquidity and dynamics. Using various liquidity mechanisms, such as margin and trade orders, traders can manage risk and maximize their returns. However, it is necessary to carefully approach these markets, because the pure rate of price movements may be disturbing.

Because the cryptocurrency market is constantly developing, it will be interesting to see how regulatory authorities react to the growing trend of liquidation events. One thing is certain: there is a risk with liquidity, and traders must vigilance to protect their capital in these fast markets.