How to use the Mark Settingment application for successful training: Opening the power of cryptoma *

Cryptocency, decentralized digitalized curnny, anxious enormous huge pesues. Installation and use continues to grow, with drivers to maximize minimizing minimizing. An effective way to achieve this is Analysant Market Sing singing the encryption currency.

What does the vintage self? *

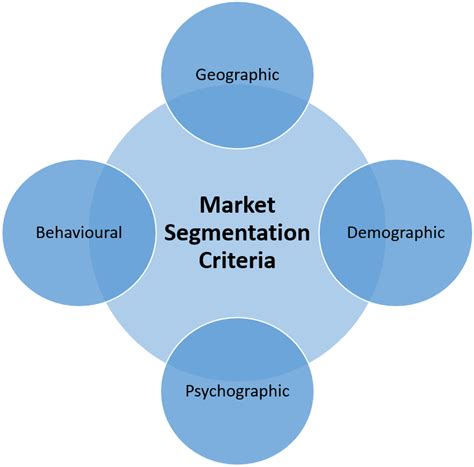

Market marks that have refreshed the invitation and drivers to a collective attitude to certain property or markets. It is a measurement of Hossimist or pessimistic individuals and institutions that is set up to continue sequels. The signed market can be expressed by various meters including:

- * Bolinger lanes: A strength-based indicator tweet measuring the differences between the upper and lower lane values.

- Modifying Strength Index (RSI) :: Precision Movements will rise to the price of the stock price range over time.

- Moving Average Confusion (MacD) : The indicator that in relation to Twing averages help identity trains and diential discharges.

Using Market System for a successful cryptocurrency store

In this art, we are looking at how to use the markets that are sent to make information -based trading in the cryptocurrency market.

- Identify Positive Witnesses : Find invitations that provide optimistic abtocurrency or asset class. This can be done by providing Semar’s assets, reducing financial networks and arches, and folling in the sources.

- Deermini negative symptoms : In contrast, identify those who who support or pessimistic about investment. This can be done by following social media, online forums and news agencies that negatively camps the property of the property.

- Use Technical Indicators : By combining markets with styles to create a more comprehensive picture of the market mood market.

Popor Cryptourarency Strategies

He was a popular trading state strategies: stove:

- Restoring the Sean strategy : This strategy that includes top or superior conditions in the Syptocurecy market and taking long/shot positions.

- * After the strategy: RSI, MACD and other technical indicators, these strategies are indefinitely trains and adapt to the underlying train.

- RENGE Trade Strategy

: This strategy that includes support and resistance levels based on bollinger bands, relative string index or other volatility-based indicators.

- NES-based trading strategy : merchants use news headlines, articles and social media for identity opportunities.

Imple Trading Plan

*

A simple research plan will be drawn up to illustrate the subcorning sent to trade for sub -fish fishing technology:

Assuming that restoring the strategy with a mobile average of 20 periods (MA), RI has 50 and MacD grid. YoM Trading Forkets, used to look like this:

- Buy Signal: Bollinger Bands Cross Abulated Regional Stratem Directory

- SEL signal: RSI exceeds less than 30

- Long Insurance: When the average return strategy indicates

* Conclusion

Market marks The AVALIVOTE tool for cryptocurrency management provides information on the intto market and opportunities. By providing opportunities and negative feelings, using technical indicators and applying them strategies, you can increase fines.

However, it is imperative to remember that it is a stupid and commerce with natural risks.