The rise of transversal trading: Explore the opportunities and challenges of the crypto

While the cryptocurrency world continues to evolve, a new phenomenon has emerged: transversal trading. This innovative approach allows users to exchange cryptocurrencies on different blockchains, allowing transparent interactions between disparate networks. In this article, we will immerse ourselves in the concept of cross trading, explore its advantages and examine the opportunities and challenges that await us.

What is cross trading?

Transversal trading refers to the transfer of assets or tokens from one blockchain to another without direct link with the underlying network. This approach bypassing the traditional limits imposed by centralized exchanges (CEX) and decentralized financing platforms (DEFI), allowing more flexible and effective assets.

BEP20: A standard for transversal trading

BEP20 is a standardized protocol developed by Binance Smart Chain (BSC), which allows the creation of standardized tokens contracts on several blockchain networks. This facilitates the development, deployment and management of transversal assets, facilitating transparent interactions between different channels.

BEP20 tokens offer several advantages:

* Standardization of tokens : Standardizing the Bep20 tokens ensures compatibility in various blockchain networks.

* Evolution : BEP20 allows the creation of standardized token contracts on several networks, increasing scalability and reducing congestion.

* Interoperability : The protocol allows transverse interactions, allowing users to move assets between the chains without restrictions.

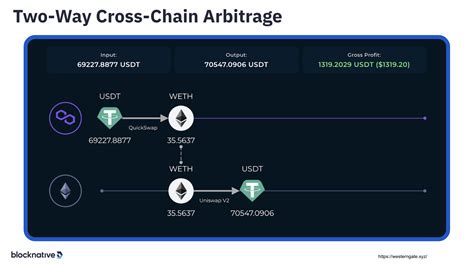

Transversal arbitration

Arbitration is a crucial aspect of the cryptocurrency markets, where price differences occur due to the differences in negotiation or liquidity costs. Transversal arbitration uses these price differences by allowing merchants to enjoy the best prices on a blockchain and exchange them on another channel.

In the context of transverse trading, arbitration refers to the practice of purchasing assets on a less liquid (or more expensive) chain and selling them on a more liquid (or cheaper) chain. In doing so, users can take advantage of price differences between channels without incurring additional costs or transaction costs.

Advantages of cross trading

Crossed trading offers several advantages:

* Increased accessibility : Transversal trading allows easier access to assets and markets that are not currently available on traditional exchanges.

* Improvement of scalability : By taking advantage of the BEP20 tokens, transversal trading allows a faster and more efficient exchange of assets on different blockchain networks.

* Improved safety : Crossed trading protocols often use robust safety measures, such as tokens normalization and decentralized governance, to protect user assets.

Challenges and limitations

Although transversal trading offers many advantages, there are also several challenges and limits to consider:

* Regulatory uncertainty : The regulatory landscape of cross trading is always evolving, which makes it essential to understand the laws and regulations applicable in your jurisdiction.

* Interoperability problems : Although BEP20 chips have an improvement in interoperability, there may be cases where assets or contracts are not compatible on different chains.

* Evolutionary challenges : Crossed trading can be at high intensity of resources, requiring significant investments in computing power and infrastructure.

Conclusion

Transversal trading represents a revolutionary approach to cryptocurrency markets, providing increased accessibility, scalability and security. By taking advantage of the BEP20 tokens and cross protocols, traders can take advantage of price differences between blockchain networks, expanding their scope and profitability.