Cakation cryptocurrencies: Cryptocurrency assessment

The world of cryptocurrency has been exploded in recent years, with over 1500% of the Bitcoins value since its basics in 2009. However, it is necessary to understand the basic principles and risk before deciding to invest in it, or take part in the cryptocurrency market on the cryptocurrency market.

What is the cryptocurrency truck?

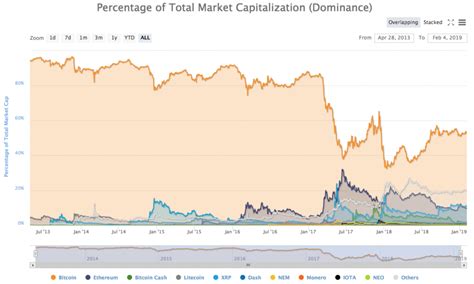

The activation of cryptocurrency refers to the value of a company operating in cryptocurrency mode, which is often measured by its market value (market ceiling). The market value is calculated by multiplying the total number of coins or cuffs on coins at the current price of the company. This allows investors to measure the total value and impact of the company’s property.

cryptocurrency literature in place

In recent years, cryptocurrency activity has increased rapidly, and some companies achieve market limits that compete in traditional industries. For example:

- Bitcoin (BTC) – 1 trillion

- Ethereum (ETH) – $ 230 billion

- Ripple (XRP) – $ 35 billion

These valuable market ceilings show significant growth and investors’ interest in these cryptocurrencies.

Factors affecting cryptocurrency literature

Several factors affect the value of cryptocurrency literature:

- Market feelings : A general approach to a specific cryptocurrency can affect its market ceiling. If investors are optimists about the project, it attracts more attention and investments that can raise the price.

- Acceptance : The degree of approval of the cryptocurrency of institutions, stock exchanges and buyers has a direct impact on its value. Since more and more companies and natural persons are investing or using some cryptocurrency, its market ceiling will increase.

- Regulatory environment : Government regulations and cryptocurrency policies may have a significant impact on their activation. A favorable regulatory environment can increase the value of the company’s property.

- Technical progress : Blockchain technology and related innovative progress may improve the functionality and utility of a specific cryptocurrency, which leads to increased implementation and investment.

Cryptocurrency risk

Although high market value may indicate significant growth potential, there is also a risk:

- Volatility : cryptocurrencies are known for their extreme variability, which means that prices can quickly and unpredictably.

- Fluency questions : In some liquidity of cryptocurrencies, the lack of liquidity makes it difficult to buy or sell funds, which leads to price instability.

- security problems : As with any digital property, there are hacking, theft or other security crimes that may affect the value of the company’s capital.

Investment strategies of cryptocurrency activation

In the world of cryptocurrency literature, it is necessary to use effective investment strategies:

- Diversification : Apply investments between various cryptocurrencies and asset classes to minimize the risk.

- Research and due diligence : Complete a thorough examination of each cryptocurrency before placing or participating on the market.

- long -term perspective : The cryptocurrency market is known for its volatility, so long -term perspective can help in conducting periods of uncertainty.

application

Activation of cryptocurrencies offers investors an exciting opportunity to participate in a rapidly developing digital property. Although high market value is a sign of success, it is necessary to understand the risk associated with it and the use of effective investment strategies.