Leverage Squat Machine

Prime Video Channel reported about release date of Leverage: Redemption season 3. As a result, the company has A rated credit. In the financial statements, this type of spoof leverage is represented under the list of liabilities. It’s a strategy for expanding your returns and accelerating growth. Section IV: Synthesis and Analysis. These traders expect drastic developments on the market and wait until the price reaches the expected level. Past performance is no guarantee of future results. An online real estate investing platform. Most industries don’t want this ratio to reach 3. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. “But beware, if the value of the stock goes down you are also exponentially increasing your loss potential as well,” says Stivers. Investing involves risk including the potential loss of principal. Here’s an explanation for how we make money. At the same time, leverage will also multiply the potential downside risk in case the investment does not pan out. There are a few types of leverage in business, including. Degree of operating leverage=Contribution marginProfittext Degree of operating leverage = frac text Contribution margin text Profit Degree of operating leverage=ProfitContribution margin. To find the equity to asset ratio companies can subtract the result by 1. US$2m per year on US$10m raised from the company’s shareholders. AvaTrade requires a Retail Trader to possess Equity of at least 50% of his Used Margin for MetaTrader 4 and AvaOptions accounts. The amount in which a purchase is paid for in borrowed money. Sang Min1 episode, 2022. For example, Bitcoin’s relative newness as an asset class is responsible for its continuous price discovery, which in turn causes volatility. Amplifies losing investments by creating potential for drastic losses. Provided that the assets develop positively in their value, investors can generate high returns in this way, even if they do not have enough equity to finance themselves. The SA CCR improves the risk sensitivity of the exposure measure in derivatives transactions to netting, collateralisation and hedging.

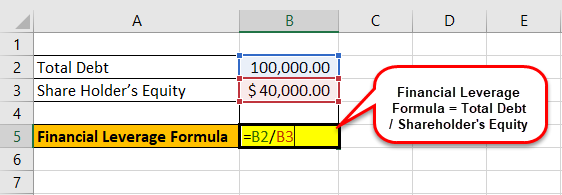

Types of leverage ratios

However, more profit is retained by the owners as their stake in the company is not diluted among a large number of shareholders. This means that a 10% increase in sales would result in a 20% increase in operating income. This financial risk is especially high in certain businesses like construction, oil production, and automobile construction, which may face the highest losses if the asset value falls. In an extreme scenario, the business could see its credit rating lowered or even be forced to declare bankruptcy should they experience problems post acquisition. Every investor and company will have a personal preference for what makes a good financial leverage ratio. With the annual financing gap for the Sustainable Development Goals SDGs rising from $2. Let’s look at Broker license loss actions what happens if the share price rises by 10%. Whereas an individual investor usually uses leverage to increase the return of their investments.

3 Determining Your Position Size

Using leverage means you can control trades of higher value than the margin you hold. For this reason, trading leverage must be used with great respect and caution as it has the potential to have disastrous effects on a trader’s finances. Cash is king in the business world. Of course, running a successful business includes more than just its finances. There are several leverage ratios that can help you compare your capital to debt. So in our example, if Jen’s sales went up by 10%, she could expect an increase in net profit of 16. Leverage ratios work as risk indicators because a borrower may face a risk of filing for bankruptcy if the company fails to repay debt on time. A lower ratio suggests that the company has sufficient equity capital to weather a business downturn.

Leverage example in the forex market

For example, for a retailer to sell more shirts, it must first purchase more inventory. 7 Unless otherwise agreed to in writing by FLEX FITNESS EQUIPMENT , the Customer waives their right to receive a verification statement in accordance with. Each broker has different requirements, and AvaTrade requires a Pro/Non – EU Trader to possess Equity of at least 10% of his Used Margin for MetaTrader 4 and AvaOptions accounts. To calculate the B/S ratios, we’d use the following formulas. As this ratio is under 1, Meta Facebook’s and Instagram’s parent company is in a pretty healthy state when it comes to managing its liabilities. Think of it as a deposit. Your browser doesn’t support HTML5 audio. Our expertise in providing alternative solutions and navigating complex legal issues helps deliver the best possible outcomes for our clients. Traders should always exercise extreme caution and always remember to DYOR to understand how to use leverage properly and plan their trading strategies. Forex The world’s most traded financial market – we offer over 80 currency pairs, from major to minor and even exotic pairs, 24 hours a day. Moreover, novices can start by trading on demos to learn basic skills and how to deal with emotions. Ease of calculation and comparability, one of the most notable is that it covers all the risks incurred by an institution. If companies use the financial leverage effect correctly, they can invest in their growth even if they do not have enough equity capital at the moment. If yes, the company’s debt related payments such as interest expense and principal repayment are supported by its cash flows and payments can be met on schedule. Three examples of financial engineering strategies are. The gang’s back together, as the main cast of Leverage: Redemption all return for season 2. Interest Coverage Ratio = Operating Income ÷ Interest Expenses. Bankrate’s editorial team writes on behalf of YOU — the reader. Others who read this also enjoyed reading. This is likely due to Hodge being a busy man at this point in his career, as he stars in City on a Hill and 2022’s Black Adam.

3 Cost of Debt

Operating leverage measures the company’s fixed expenses as a percentage of its overall costs. Investopedia / Lara Antal. You can set your browser to block these cookies, but parts of our website will then stop working. If you enjoyed this article, read our guide on how to read candlestick charts and patterns. If the price of the position drops, a margin call may be issued, and the trader may be forced to liquidate. The fun will be is to see how they move forward. Carbon Collective partners with financial and climate experts to ensure the accuracy of our content. Difference between leveraged and other forms of financial trading. But what is leverage ratio.

Fast Account Opening in 3 Simple Steps

When reading finance related news or going through a business magazine, you must have come across many commonly used financial terms that may not have made sense at first glance if you are not already familiar with them. 000+ traders worldwide that chose to trade with Capital. Debt to capital ratio The formula is “total debt/total capital tier 1 + tier 2”. To see our product designed specifically for your country, please visit the United States site. The FLM essentially gives you an idea of how many times the total assets of a company are to its equity. Ultimately the bank will. The third type of leverage ratio relates to consumer debt, which is compared to disposable income. Basis is simply the relationship between the cash price and future price of an underlyi. Leverage is used to see by how much your trade will multiply if it succeeds or how much your losses may account for if the price drops. These cookies store data that lets us make the page secure and safe.

Langston Fishburne

Financial leverage part of the financing activities of a firm refers to the proportion of debt in the overall company’s capital structure. Effective formal assessments are used at the end of a unit of learning. To enable the risk of excessive leverage to be assessed, institutions report all the necessary information relating to the leverage ratio and its components to the national competent authorities on a quarterly basis. In finance, leverage, also known as gearing, is any technique involving borrowing funds to buy an investment. Jim Abel1 episode, 2021. This may occur when the asset declines in value or interest rates rise to unmanageable levels. The origins of leverage in finance can be traced back to the creation of modern banking institutions in the 17th century. Instead of using long term debt, an analyst may decide to use total debt to measure the debt used in a firm’s capital structure. A company can analyze its leverage by seeing what percent of its assets have been purchased using debt. Nevertheless, finding this type of lender is challenging. Local Casting 16 Episodes. Revised read only version unofficial text. 5% or less is considered favorable. Whether you’re trading margin or perpetual contracts using leverage, borrowing funds comes with its own extra costs. However, companies that need to spend a lot of money on property, plant, machinery, and distribution channels, cannot easily control consumer demand. They bet on the growth or fall of the underlying asset, which in this case is the currency against the quoted currency. Higher ratio values might indicate more substantial risk due to increased obligations and increased borrowing. Conversely, Walmart retail stores have low fixed costs and large variable costs, especially for merchandise. Since companies require cash to service their debts, it is better to use operating cash flows, rather than EBIT in the computation of the interest cover ratio. A higher debt to asset ratio means that a business is more heavily reliant on borrowed funds. Check out a few examples below to see how to calculate leverage ratios. Keith loves exploring different cultures and the untouched gems around the world. I can still recall the number of times I dozed off while studying, or just going back and forth trying to understand even the simplest concept.

What Is a Management Buyout: Everything You Need to Know

Also, it’s helpful to see the tax benefits of financial leverage outlined, as this is something that may not be immediately obvious to those new to investing. In this case, if the asset appreciates by 40%, its value would also become Rs. While theoretically risk based requirements are an ideal way to map risk to capital requirements — the more risk a bank takes, the more capital it must hold — underlying this mapping is a model, and if you’ve ever done any modelling yourself, you’ll know they’re far from perfect. Be mindful when analyzing leverage ratios of dissimilar companies, as different industries may warrant different financing compositions. Collaboratively, co teachers instruct all students with inclusive high leverage practices, using different co teaching approaches. Leverage is the use of a smaller amount of capital to gain exposure to larger trading positions, also known as margin trading. Operating leverage is one of the more important considerations when analyzing a company, but it is one of the more underutilized ideas. If a company has a low equity multiplier it means that it has financed a large portion of its assets with equity. Before you start borrowing money to buy stocks or invest in mutual funds, it’s important to understand the pros and cons of financial leverage. A company that performs well in a given period will have more residual net income, which can either flow into retained earnings or be issued as shareholder dividends. I’m totally confused, espesially with the 3rd option. And join us again next week. Calculated this way, a low leverage ratio indicates that a bank has a high level of debt in relation to its Tier 1 capital. In margin trading, you should also retain a margin balance, commonly known as a maintenance margin, in your account to take care of losses. Although you only put up part of the money, your profit or loss will be based on the total value of your position, which is larger because of the borrowed money. When home prices fell, and debt interest rates reset higher, and business laid off employees, borrowers could no longer afford debt payments, and lenders could not recover their principal by selling collateral. By taking on debt, companies can borrow money to purchase more assets or to expand operations. What is the consolidated leverage ratio. While professional clients can access higher leverage rates, they must meet strict criteria in order to be eligible. Get the freshest reviews, news, and more delivered right to your inbox. These are just some examples of when the LBO benefits both parties. Meanwhile, Breanna’s gaining confidence in her skills and the ones she’s picking up from the others. Air date: Dec 7, 2022. With its registered office in Warsaw, at Prosta 67, 00 838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register Krajowy Rejestr Sądowy conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number NIP 527 24 43 955, with the fully paid up share capital in the amount of PLN 5.

Join Wallstreetmojo Youtube

I saw her more as a friend,” he says. It’s represented in the form of a ratio. Note: LIBOR is going away and being replaced by SOFR. Suite 105A, Airivo, 18 Bennetts Hill, Birmingham, B2 5QJ. The product of the two is called total leverage, and estimates the percentage change in net income for a one percent change in revenue. Arthur Damian O’Hare and Ramsey Ralph Brown are under arrest, though they’re crafty criminals who could easily escape. Access and download collection of free Templates to help power your productivity and performance. Please lose annoying Breanna. Economic leverage is volatility of equity divided by volatility of an unlevered investment in the same assets.

Exclusive Crypto Deal List of 2023

Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and control—a huge amount of money. In the design of the sequence they make decisions about which lessons are central to their learning goals and which lessons need to be modified or eliminated. Org is not related to any government body and certainly not related to any corporation. As a Manager, Andrew is responsible for developing Convergence’s data and research activities, including building out Convergence’s database of historical blended finance transactions and developing blended finance trends analysis and benchmarks. However, if a company’s operations can generate a higher rate of return than the interest rate on its loans, then the debt may help to fuel growth. Leverage is a key feature of CFD trading and can be a powerful tool for you. Legal Information: The domains and are owned and operated by First Prudential Markets Ltd registration number HE 372179, a company authorised and regulated by the Cyprus Securities and Exchange Commission CySEC License number 371/18. The leverage is expressed as a ratio of the margin to the potential loan amount. In the second literacy methods course, interns continue to analyze their planning and enactment of IRAs. Reduces barriers to entry by allowing investors to access more expensive trading opportunities. Chapter 6: Providing Specially Designed Instruction in Inclusive Settings. The use of leverage is beneficial during times when the firm is earning profits, as they become amplified. Because the new location could increase appliance sales and market reach, the appliance retailer can justify financing the purchase instead of using its equity. But that isn’t always the case. Follow the vital steps to calculate your DOL, and keep checking it periodically to make sure it isn’t changing. The Pavillion, 175, Bannerghatta Main Rd, Dollar Layout, Bengaluru, Karnataka 560076. I’ll use HubSpot’s financials demonstrate the operating leverage formula. Subscribe to our weekly newsletter for more. This must be paid irrespective of the operating profits. A lever does not bend or create additional friction. Ten to one leverage, written as 10:1, is a leverage ratio that denotes a 10% margin requirement. The product of the two is called total leverage, and estimates the percentage change in net income for a one percent change in revenue. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. “I would imagine that there were things that the team has done to help him, and he’s done things with the team in the interim, but his relationship with Eliot is really bad. The leverage effect is particularly pronounced in the case of start ups, as they have hardly any equity capital and are financed almost entirely from borrowed capital. AG James Hodgins1 episode, 2022.